Learn everything you need to know about startup capital

By Michael Daniel, First Street Processing

Introduction

Starting a business is exciting, but without a clear financial roadmap, it can quickly become overwhelming. I’ve seen it firsthand. In The Story and The Rest of the Story, I shared how my parents launched a sign company with grit, creativity, and heart, but without a solid understanding of startup costs, cash flow, or capital planning. Their experience taught me one of the most valuable lessons in entrepreneurship: you can’t build a business on hope alone; you need a plan.

This post is your guide to funding your dream business so you can launch it with confidence. Whether you’re starting a consulting firm, a creative studio, or a retail shop, understanding your startup capital needs is critical. We’ll walk through three essential tools that every entrepreneur should use before spending a single dollar:

- What Are Startup Costs

How to determine startup capital needed for your business

Learn how to identify and categorize the real costs of launching your business, from equipment and inventory to soft costs like legal fees and branding. I’ll share an example from Big Mike’s Consulting using the Startup Capital Worksheet (it’s your secret weapon for planning with precision). - The Sources and Uses Table

What will the money be used for? Where do you expect to get the capital?

This simple but powerful table helps you map out where your startup funds will come from, and exactly how they’ll be spent. I’ll include a real-world example from Big Mike’s Consulting to show how this tool brings clarity to your funding strategy. - Understanding Cash Flow and Burn Rate

What is cash flow and burn rate?

Once your business is up and running, cash flow becomes your lifeline. We’ll break down what it means, how to calculate your burn rate, and why it’s critical to know how long your startup capital will last.

If you’re serious about launching your business the smart way, these tools will help you avoid costly surprises and build with confidence. Let’s dive in.

Want to learn more about business planning? Get Smart Start: The Essential Guide to Business Planning

The Story…

When I was fifteen years old, my parents decided to start a sign company. My dad was a uranium geologist, and he was growing increasingly concerned about the future of his career, and with good reason. It was 1979, the year the Three Mile Island Nuclear Generating Station near Harrisburg, Pennsylvania experienced a partial meltdown. The incident sent shockwaves through the nuclear energy industry. While no lives were lost directly, the fear of a nuclear catastrophe was real, and it led to the collapse of many uranium mining projects. My father didn’t lose his job immediately, but the writing was on the wall.

To hedge against the looming uncertainty, my parents launched a sign company. It seemed like a sound idea at the time. My father still had a paycheck, and my mother could manage the day-to-day operations. They were no strangers to hard work, having grown up during the Great Depression and lived through WWII and the Korean War. Both were educated, resilient, and resourceful. Starting a business should have been straightforward, right?

Like many entrepreneurs, they skipped the market research and financial planning. They jumped in based on an opportunity to buy equipment from a defunct sign shop that specialized in magnetic signs for automobiles. I’ll never forget the excitement of riding with my dad to pick up the gear, an old analog typesetting machine and a thermal vacuum press for making 3D magnetic signs. In their minds, the business was simple: a narrow niche, a few pieces of equipment, and a yellow pages ad. That was the extent of their startup cost planning, or so they thought.

1. What Are Startup Costs?

How to determine Startup Capital needed for your business

Startup costs are the onetime expenses that come with launching your business. Every business has onetime startup costs. Even if you are a solopreneur like an influencer, podcaster or independent sales consultant, you have onetime expenses associated starting your business. Understanding the cost to start and operate your business is foundation needed to prepare financial projections and cash flow statements. If you plan to seek financing for your business, you must have a clear understanding of the cost of starting and operating your business.

When I’m writing business plans, I ask the “who, what, when, where, how and why” questions as I’m working my way through each section of the business plan. Answering these questions help define and justify expenses related to your startup costs. Basically, you need to determine if it’s an “essential expense” or a luxury. Start by making a list of equipment that you feel are essential to starting and operating your business. Ask yourself “what is needed”, “why it is needed”, “how it will be used”… You get the idea. Create an expansive list of everything you think you will need to start your business. Be sure to include marketing expenses related to your launch and continued promotional expenses needed to increase sales.

What’s the cost to Own your niche?

I love this photo because this antique dealer understands their niche. This picture screams nostalgia! If you love those types of antiques, this would be your favorite store.

So, how does this relate to startup costs? If you want to be successful, you must ask and answer; “What is the cost to own your niche?” Inventory, marketing, signage, website…

Think of things like:

- Equipment and furniture

- Initial inventory

- Licenses, permits, and insurance

- Marketing and promotion budget

- Website design & Hosting

- Rent, utilities, and payroll

- Computer and or Point of Sale system

- Software expenses

- Legal and accounting fees

- Payroll – Training

- Working capital for 3 to 6 months

Getting these numbers right the is really important. If you miscalculated by a large margin, it could be critical. That’s why I always recommend creating a Startup Capital Worksheet with three scenarios: Best Case, Worst Case, and Most Probable. Planning for all three keeps you flexible and realistic.

The Startup Capital Worksheet, your secret weapon.

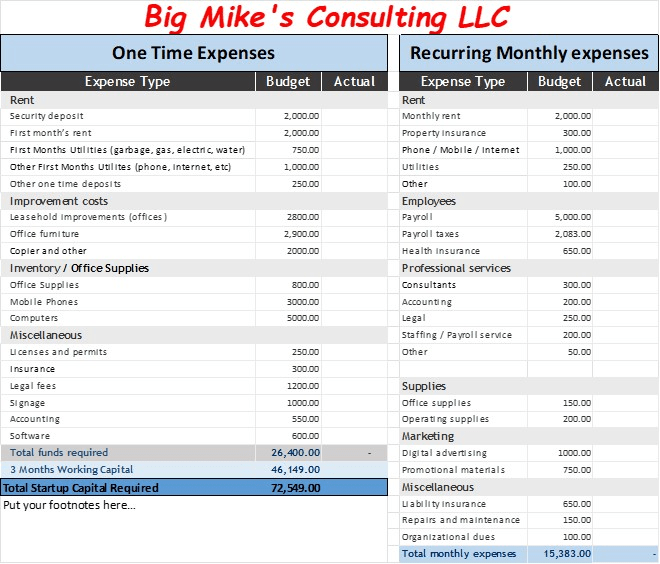

Take a look at Big Mike’s Consulting, LLC. Big Mike determined that his total startup costs will be $26,400. However, he knows that it will take time to build a clientele, so he will need three to six months working capital. In order to determine the amount of working capital you need, you have to understand your ongoing monthly expenses. Those recurring expenses are the basis for building your financial projections.

Big Mike’s recurring monthly expenses are $15,383. That means that if he doesn’t generate any revenue during the month, he will have to pay out of pocket $15,383. Because Big Mike is a consulting firm, he knows that there will be a lag time between when he makes the sale and is paid for the services. All businesses have a ramp up period, some are days, some are months. You should plan to have enough working capital to pay all of your expenses for the first 3 to 6 months. In Big Mike’s example, he estimates that he will need $46,149 in working capital.

Tools for success – Bluehost and WordPress

Every new business needs a great website. Bluehost has what you need to build an awesome website. They have incredible resources to help you create and run your ecommerce business. Here’s why I chose Bluehost:

- Free domain for the 1st year (really great deal for new businesses)

- AI site creation tools that are awesome

- 1-Click WordPress Insall with hundreds of customization themes and options

- Expert Support 24/7 (super friendly and helpful, and I’ve called with some really simple questions)

This is an affiliate link. This means that if you click on the link and make a purchase, we may earn a small commission at no additional cost to you.

2. The Sources and Uses Table

What will the money be used for? Where do you expect to get the capital?

Once you’ve identified your startup costs, it’s time to build your Sources and Uses Table. Think of this table as your funding blueprint. Bankers, investors, and lenders love it because it shows that you’ve thought through the details of how you are going to start and fund the business. The Sources and Uses table quantifies where you expect to get the money to start your business (Sources) and how it will be spent (Uses). Banks, finance companies and investors will want to see all of your financial projections, and they will want to see the source and uses table to understand the complete financial picture.

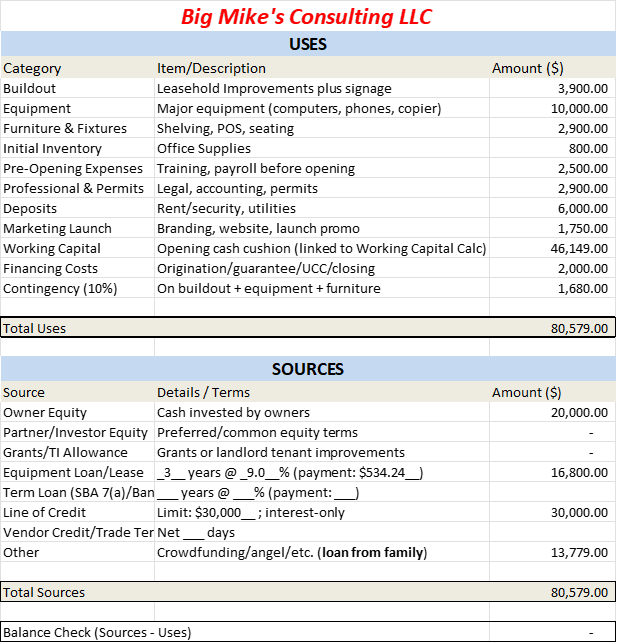

The way to prepare this table is to start with the where the money (capital) will be used in the process of starting your business. Since you’ve already completed the Startup Capital Worksheet, completing the Sources and Uses Worksheet is simple. Most of the same items will be transferred over to this worksheet. When Big Mike prepared his Sources and Uses, he discovered a couple of other expenses that he hadn’t accounted for 1) Pre-opening Expenses – training and payroll 2) Marketing Launch expense 3) Financing Costs – loan fees and legal fees 4) He added a 10% contingency to his leasehold improvements. Completing the Sources and Uses Worksheet gives you an opportunity to re-evaluate your startup expenses and make sure that you have accounted for everything.

When you’re starting a business, it’s essential that you track every single expenditure in your process. If you spent money on market research, track it. If you invested in classes that are pertinent to your business, track those expenses. I’ve started numerous businesses, and I’m always amazed at how much I’ve spent just preparing to open the business: market research, business planning, forming my LLC, and covering legal and accounting fees. These are what we call soft costs, and they are foundational, often overlooked investments that don’t result in physical assets but are absolutely critical to launching your business. From licenses and professional services to branding and insurance, these costs shape your business before you ever open your doors.

Interested in learning more? Get Smart Start: The Essential Guide to Business Planning. It encourages entrepreneurs to treat soft costs as strategic, not optional. By capturing them early, you avoid cash flow surprises and build a more realistic, resilient plan from day one.

Why is this important and how does it relate to startup capital?

Figuring out how you are going to get enough capital to start your business is a bit like doing a puzzle. In the example above, Big Mike knows that he will need $80,579 and he has about $20,000 in savings that he can invest. Where will he get the rest of the money needed to start Big Mike’s Consulting?

First, start with looking at your own personal savings and investments. How much do you have available and are willing to invest in your business? The money that you personally invest into your business is called owner’s equity. Using your personal savings, investments, or your home equity demonstrates your commitment to the business and may improve your chances of securing additional capital from a bank or investor.

Second, determine the amount of money still needed to start the business. In Big Mike’s case, he only has $20,000 available to invest, but figures that he will need a total of $80,579, therefore he still needs $60,579 in capital. Often entrepreneurs use a combination of personal savings, credit cards home equity and loans from friends or family to fund their business. If you chose to borrow from friends or family, make sure that you create a legal promissory note with explicit terms.

Third, list all potential funding sources on the Sources and Uses Table to clearly identify that source of capital. In Big Mike’s case, he is borrowing $16,800 from a small business equipment finance company. He secured a $30,000 line of credit from his bank, secured by his home. Finally, he has a loan with family for the remaining $13,779. Finding the right mix of funding sources is essential to ensure your venture’s stability and long-term success. Make sure that your funding is solid and in place prior to starting the business.

At First Street Processing, we even provide a free downloadable Financial Statements Template to help you calculate your startup costs, sources and uses, and cash flow projections.

👉 Download the Financial Statements Template

Learn more about startup costs at the U.S. Small Business Administration.

3. Understanding Cash Flow and Burn Rate

What is cash flow and burn rate?

For a new business, cash is king and understanding where it comes from and where it goes will help you survive the early months of growth. Statement of Cash Flows helps you understand how much money is coming into the business through sales and or loans and where and how you are spending it. It is one of the most important financial tools for any entrepreneur. Unlike the income statement, which records revenues and expenses when they are earned or incurred, the cash flow statement tracks the actual movement of cash in and out of your business. This difference is critical because you can appear profitable on paper while still running out of cash in real life. When you run out of cash, you can’t pay rent, payroll, or payroll taxes. Managing your cash flow is essential to your success.

The Statement of Cash Flows serves two primary purposes for the entrepreneur. 1) Planning monthly cash flows – It provides a clear picture of when money will be available to pay bills, payroll, suppliers, and other obligations. 2) Determining your burn rate – This is the pace at which your business spends cash before becoming profitable. Knowing your burn rate allows you to plan how long your startup funds or reserves will last and helps you anticipate when you’ll need to raise additional capital or cut expenses.

How to Prepare a Cash Flow Statement

Preparing your statement of cash flows is a straightforward but powerful exercise. To get started, break it down into three sections:

1) Cash Inflows (Money Coming In):

- Sales revenue (cash from customers)

- Loans or investor funding

- Owner contributions

- Any other sources of income

2) Cash Outflows (Money Going Out):

- Rent, utilities, insurance, and other overhead

- Payroll and contractor payments

- Inventory or raw materials

- Marketing and advertising

- Loan payments or interest

- Taxes and fees

- Software licenses

- All recurring expenses

3) Net Cash Flow (Cash Balance):

Subtract your outflows from your inflows for each month. This gives you the net cash flow and shows whether you’ll have a positive or negative balance. By laying out this information month by month over a 12-month period, you’ll be able to see patterns and anticipate challenges before they happen.

Using the Worksheet

I recommend using a 12-month cash flow worksheet to estimate your business’s financial needs. Start with realistic assumptions about your revenue ramp-up, then layer in fixed and variable expenses. Update your worksheet monthly with actual results, comparing them to your estimates. This habit will not only sharpen your forecasting skills but also give you an early warning system if your cash balance is running low. Remember, your cash flow statement is more than just a financial report, it’s a planning tool. By keeping a close eye on your inflows, outflows, and burn rate, you’ll position your business to grow steadily, avoid unexpected shortfalls, and make smarter financial decisions.

Here’s a reality check: in the first few months, your expenses will likely exceed your income. That’s why you need a cash flow statement this simple tool will help you understand how money moves in and out of your business. A good rule of thumb? Set aside three to six months of operating expenses as working capital. It’s your safety net while your revenue builds.

The rest of the story… (continued from the top)

My father, a talented cartographer who had made maps during the Korean War, became the company’s graphic artist. My mother took charge of sales and marketing. During the day, she made sales calls and wrote up quotes. At night, the three of us worked together to make the signs. Dad designed and typeset. Mom handled the books and ensured every order matched the quote. I painted and helped package for delivery.

For a while, things went well. Mom was a natural salesperson, and Dad’s artistic skills gave the business a professional edge. But cash flow was tight. My mother had left her nursing job, and the business income was unpredictable. They had a vision, but no formal plan, and no clear understanding of the total capital required to start and sustain the business.

Eventually, they began chasing cash flow instead of sticking to their niche. They accepted orders for building signage and standalone signs, which required new equipment and more investment. The business drifted from its original focus.

Then everything changed. My father suffered a heart attack, followed by an aneurysm. He survived, but couldn’t continue at the same pace. With mounting medical bills and no graphic artist to carry the creative load, my parents made the difficult decision to close the business. My mother returned to nursing.

Looking back, I have fond memories of that time. I learned a great deal about entrepreneurship from my parents’ journey. But in hindsight, even if my father had remained healthy, the business likely would have failed, not because they lacked talent or drive, but because they didn’t understand the full cost of starting and operating a business. They saw an opportunity and jumped in without writing the plan.

Want to learn more about business? Check out these other helpful articles.

Jump Start your new venture with Smart Start

Plan Smarter, Launch Stronger with Smart Start: The Essential Guide to Business Planning

Thinking of starting a business? Maybe you want to refine your business. Then you are in the right place. Signup now for our Business Trends Newsletter, and we’ll send you this five-part guide absolutely free. The SMART START Guide is designed to help aspiring entrepreneurs and small business owners develop a comprehensive plan for starting and growing their business. This five-part guide walks you through key steps such as conducting market research, defining your target audience, preparing financial projections, and identifying funding sources. It emphasizes the importance of evaluating risks, understanding your competition, and assessing your personal readiness before committing to your venture. By following this guide, you’ll gain the tools and insights needed to make informed decisions, improve your chances of success, and build a thriving business.

Get Started now, download Part 1: Market Research and Competitive Analysis. Then each day, we’ll send you an email with a link to download the next part in the series. Each part is packed with actionable insights to help you plan, fund, and structure your business the right way.

Here’s what you’ll receive:

Part 1: Market Research & Competitive Analysis

Part 1: Market Research & Competitive Analysis Part 2: Startup Capital

Part 2: Startup Capital Part 3: Choosing Your Business Structure

Part 3: Choosing Your Business Structure Part 4: Writing a Winning Business Plan

Part 4: Writing a Winning Business Plan Part 5: Funding Your Business

Part 5: Funding Your Business

💡 Start processing payments now

Starting your business is a big step, and First Street Processing is here to help you succeed. When you sign up to process credit cards with us, you’ll receive a FREE credit card terminal, a $300 value to help you start accepting payments with ease. Take the first step in building your successful business today. Contact First Street Processing to learn more about this special offer and how we can support your payment processing needs.

Whether you need a payment processing terminal or a virtual terminal for recurring payments. We’re here to help guide you and help you with the best payment processing solutions. At First Street Processing, our mission is to help you save money, save time and grow your businesses.

Build Smarter with Bluehost

When I launched my site, I didn’t just need a place to park a domain—I needed a partner. After trying a few other hosts, I landed on Bluehost, and the difference was immediate: real support, real tools, and real peace of mind.

Whether you’re building a business site, a blog, or an online store, Bluehost makes it easy. With one-click WordPress installs, AI-powered site creation, and a free domain for your first year, you’re set up for success from day one.

And when you hit a snag? Their 24/7 expert support is just a click away.

Get your domain name and website now!

This is an affiliate link. This means that if you click on the link and make a purchase, we may earn a small commission at no additional cost to you.

Tailor Brands

Form Your LLC fast

Launching a business doesn’t have to be overwhelming. With Tailor Brands, forming your LLC is as straightforward as it gets. Their platform guides you step-by-step—from choosing your business name to filing the paperwork—so you can focus on building, not stressing.

Whether you’re a solo creative, a side hustler, or ready to go full-time, Tailor Brands has a package that fits. The Essential Plan covers the must-haves: LLC formation, EIN, Registered Agent, and compliance support. Want to go further? The Elite Plan adds branding tools and a website builder to help you look as professional as you are.

This is an affiliate link. This means that if you click on the link and make a purchase, we may earn a small commission at no additional cost to you.

Michael Daniel is a business advisor and founder of First Street Processing. With three decades of experience in finance and entrepreneurship, he helps small businesses build smart plans, streamline operations, and grow profitably.